Arkansas Tax

FULL List to Arkansas Tax Forms

Individual Income Tax Forms

Form AR1000CR Individual Income Tax Composite Return

Form AR1000F Individual Income Tax Return

Form AR1000NR Individual Income Tax Return Non Resident

Form AR1000S Individual Income Tax Return Resident Short Form

Corporate Income Tax Forms

Form AR1100CT Corporation Income Tax Return

Form AR1100CTX Amended Corporation Income Tax Return

Sales Tax Forms

Form Arkansas Consumer Use Tax Return

Primary Concerns:

The most significant recent issues that have effected taxation in Arkansas has been centered heavily on increasing unemployment taxes that many businesses now pay, due to the increasing amounts of state residents seeking unemployment benefits.

Arkansas’s taxation also has an interesting history in trying to regulate both alcohol and cigarette use by demanding fairly high tax rates on both forms of product.

Income Taxes:

All residents of Arkansas or non-residents who draw income from businesses, employment, trusts, or properties located within the state are required to pay Arkansas income tax on their income.

Those with taxable income of $3,700 or less pay a 1% income rate. The rate for incomes between $11,100 and $18,600 is 4.5%, while between $18,600 and $31,000 the rate is 6%.

Instead of having recognizing returns that are classified as being single, filing jointly or head of household, Arkansas offers tax credits for these classifications.

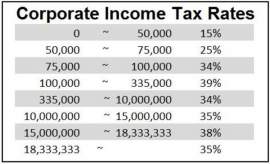

Corporate Income Taxes:

All businesses and corporations that either reside in Arkansas or do business in state are subject to Arkansas income taxes. This can seem somewhat complicated, but becomes clearer when explained.

The first $3,000 of corporate income have a tax rate of 1%. What this means is, if an Arkansas business earned $6000 in income for a year, the entire $6000 will NOT be taxed as 2%, only the second $3000.

From there the next $5000 earned will be 3%, the next $14,000 will be at 5%, the next $75,000 will be at 6%, and any income over $100,000 will be taxed at 6.5%. Everything $100,000 and under will be prorated at the lower rate (All of the previous brackets add up to $100,000: $3,000 + $3,000 + $5,000 + $14,000 + $75,000 = $100,000).

Corporations with a sustainable net operating loss may carry it forward for five years as a deduction.

Property Taxes:

Property taxes in Arkansas are generally operated on a county by county basis. The state does not set or collect property taxes; taxes are set and collected by the county of residence (and Arkansas has 75 counties). In general, Arkansas counties usually tax most property no matter the purpose or use.

This includes vehicles, which are taxed at their assessed value, which is usually 20 percent of market value multiplied by the mileage rate (which varies from county to county).

Sales Taxes:

The standard Arkansas state sales tax is 6%, and it is fairly standard across the state on most saleable items. Many municipalities add additional sales taxes on top of these rates; the city of Little Rock adds an additional half percent to its sales tax.

Because of its history as a “dry” state, meaning that many counties have historically placed restrictions on alcohol sales (with many counties still doing so), the state has a comprehensive listing of various tax rates on alcohol beverage purchases, with beer commanding a 1% sales tax, while mixed drinks boast a whopping 10% sales tax.

NEXT: California State Tax