Special Sales Taxes You Should Know

There are several types of excise taxes and several of those are considered special sales taxes. Special taxes are imposed on items as a "sin" tax. In essence, these taxes are imposed on items that cause harm to the consumers health and sometimes to the health of those around them. For example, a person that consumer alcohol excessively, will likely have health problems that result from their drinking.

In addition, the person may chose to drive, or be in a position of responsibility while under the influence of alcohol, which could have disastrous results. For this reason, excise taxes are imposed to cover the cost of such negative consequences. The tax revenue may also be used for educational campaigns to discourage detrimental behavior. Most importantly, it is believed that the excise tax discourages the purchase of such items, or the excessive purchase of such items.

Cigarette taxes are imposed as an excise tax. Cigarettes taxes can be imposed on three levels. The federal cigarette tax is around one dollar a pack and could increase in the immediate future.

State cigarette taxes range from several cents to five dollars a pack. In addition, local governments may also levy an additional excise tax on cigarettes sold in that jurisdiction. Citizens that travel to other states to purchase cheaper cigarettes, will be subject to the use taxMotor Fuel Tax:

The motor fuel tax is imposed on gasoline and the rate of tax varies greatly from state to state. That excise tax can be as much as half of the price the consumer pays for a gallon of gasoline. The tax may be imposed by the federal, state and local tax jurisdictions.

The taxes are usually applied to gasoline and diesel, as they are utilized for transportation. Items like heating oil, may be taxed differently. The gasoline fuel tax is often considered to be income elasticincome inelastic.Tax on Alcohol:Authorization and Administration:

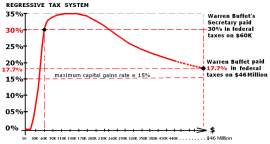

Taxes in the United States continue to be a point of contention. Many United States citizens argue that, as a nation, we are overtaxed. There have been many arguments against taxation as it stands now. Due to the bad economy, many Americans are struggling to make payments and purchase basic necessities. For that reason, some have recommended a decrease in certain types of taxes. In fact, there are many arguments that support the idea of lowered taxes, to increase individual savings.

Later, those savings will include increased personal spending, and an increase in tax revenue. Conversely, there is an argument that taxes are a necessity, in order to aid the government in running a smooth operation. In fact, many arguments claim that lowering taxes would cause immense harm to an economy that is already suffering. In any case, Congressdue processFederal courts

NEXT: Sales Tax State Variations