Current Rates on Capital Gain Taxes

The capital gain tax rate differs for long term investments and short term investments. Capital gain tax rates treat short term investments as regular income except under certain circumstances. The rate of inflation is not considered as a factor for capital gain tax rates. In other words, profits that are a direct result of inflation, are considered under the same tax rate as those that made a profit due to other factors.

This rule on the capital gains tax rate can be a surprise for homeowners. For example, a person that has had their home for twenty years, will likely make a profit from the sale of that home. However, that profit is likely to be due to the rate of inflation. Most items, especially homes, increase in value in proportion with the rate of inflation.

Yet, that factor is not considered as part of capital gains tax rates. There are some intervening factors that will alter an individuals capital gain tax rate. The age of a person that sells their home, personal capital losses and the amount of other income, are all factors that can influence an individuals capital gains tax rate.

For short term capital gains, investments that were sold after less than a year, the profit is considered as regular income and can be taxed at a rate as high as thirty eight percent. The short term investment timeline begins on the day after the purchase, not the day that the item was actually purchased. If the item is sold before three hundred and sixty five days have passed, that item is considered a short term capital investment. If the item is sold at a loss to the investor, it can be deducted from any short term capital gains.

If however, the item is sold at a profit, it is taxed at the higher capital gain tax rate than a long term investment would be. For most investors, the capital gains tax rate will be determined according to their income and any capital losses that can offset their gains for that year.

In fact, capital losses can be deducted indefinitely, until the full amount of the loss has been deducted from capital gains or income of the investor. The capital gain tax rates make an allowance for the indefinite deduction because there is a maximum allowable amount for deductions in each tax year.

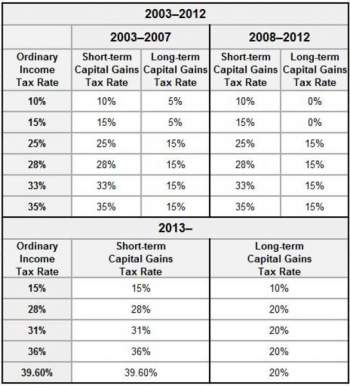

To more clearly define actual capital gain tax rates, a taxpayer must take their income and length of investment into consideration. For example, a short term investment will be taxed at the regular rate of other income. Conversely, a long term investment is taxed at a much lower rate. Certain capital gains tax rates are set to expire in 2010 and most rates are expected to increase.

United States Capital Gains Taxation (2008-2012)

Ordinary Income Short-term Capital Long-term Capital

Tax Rate Gains Tax Rate Gains Tax Rate

10% 10% 0%

15% 15% 0%

25% 25% 15%

28% 28% 15%

33% 33% 15%

35% 35% 15%

United States Capital Gains Taxation (2013+)

Ordinary Income Short-term Capital Long-term Capital

Tax Rate Gains Tax Rate Gains Tax Rate

15% 15% 10%

28% 28% 20%

31% 31% 20%

36% 36% 20%

39.6% 39.6% 20%

NEXT: Deferring and Reducing Capital Gains Taxes