The Facts on Tax Collection

Tax Collection Background:

The federal government of the United States enforces a tax levy on its citizens to fund necessary public projects such as:wars, national parks, social security, construction of roads, and Medicare.

To properly fund these projects the Internal Revenue Service (federal organization responsible for taxation) enforces taxes on the majority ofindividuals and profit-based businesses in America. The federal tax levy encompasses a variety of methods, and demands taxes to be paid on income, investments, medicare, social security, excise, sales of consumer goods, estate, and gifts. Failure to pay these varying forms of taxation will result in penalties, fines, exorbitant fees, and depending on the severity, a prison sentence.

The Internal Revenue Service was created to collect taxes on American citizens, it was established as a powerful tool used by the federal government to ensure the national levying system. Unpaid taxes represent a deficit in public funding, which in turn, mitigates the overall effectiveness of the national government. The severity of this deficit is exemplified through the dogged techniques used by the IRS to collect such unpaid taxes. In addition to charging fees and interest on unpaid returns, the IRS can seize an individuals property through the Federal Tax Lien, and subsequently sell the asset using a notice of levy.

Tax Collection Statistics:

The true taxing power of the Internal Revenue Service is revealed simply by looking at tax collection statistics found at the IRS website. In 2007 there were over 138 million tax returns in the United States. From the 138 million returns, the federal government collected 1.3 trillion dollars (gross collection) in income tax alone. The 1.3 trillion accounts for over 50% of the total funds collected by the federal government during the 2007 taxing period. These statistics reveal the importance and enormity of the individual tax levy in America.

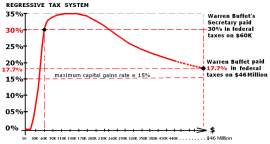

The federal income tax in the United States is a progressive system-the more an individual makes the higher tax rate he/she will be placed under. The highest tax rate in America for instance taxes individuals at 35%. This 35% levy is only placed on individuals making over $373,650 in annual salary. Although a capitalistic society, America enforces a large obligation on the biggest wage earners-the top tax bracket routinely accounts for 60-65% of the federal income tax levy. Statistics are also crucial for understanding how these funds are re-invested into public goods and services. In 2007 for instance, the majority of the tax dollars were spent on Medicare (33%) and the U.S. military (20%.)

Outsourcing of Collection:

Uncollected federal taxes are a mounting problem in America. The IRS estimates that between $270 and $300 billion dollars go uncollected each taxing period. The uncollected taxes pose numerous negative externalities on society such as, cut-backs or deficits in regards to the supply of public goods and services. The number of tax claims that go uncollected increases and carries over to the next year. To alleviate and streamline the collection process, the IRS hired numerous debt collection agencies in 2005.

The inclusion of collection agencies was administered to pursuit small accounts to avoid carry over, allowing the IRS to focus its energies on bigger, more complicated cases. Numerous problems quickly arose however, as the agencies charged an obscene fee (25-30% of collection) and individuals complained that their private tax information was being exchanged with sketchy 3rd parties. The outsourcing method quickly died and the IRS has attempted to answer increased evasion through strengthening its agency from within.

NEXT: The Outsourcing of Collection Process