Modern Legal Interpretation of Income Taxes

Federal income taxes were made legal when the Sixteenth Amendment was ratified by Congress. Prior to the Amendment, Federal income taxes were declared unconstitutional in Pollock V Farmers Loan and Trust. In fact, income taxes were introduced on several occasions throughout the countries history. Income taxes were also repealed on several occasions and a final determination was not made until the Amendment was ratified.

After ratification of the Sixteenth Amendment, there have been many legal challenges as to the constitutionality of income tax. However, income taxes have been upheld as constitutional is every case. The arguments against the constitutionality of income taxes have been declared as frivolous by the courts in every case since Pollock. Pollock declared that income taxes were a direct tax, and therefore unconstitutional. Since Pollock, The Sixteenth Amendment has been interpreted as legal and the courts have also declared that the Amendment was in fact ratified.

There have been many arguments against Federal income tax. There are groups of people around the country that argue that Federal income taxes are a form of enslavement of the American people. By forcing people to pay Federal taxes on their income, it is argued that the government enslaves citizens. However, that argument had consistently been struck down. There are also those that argue that the Amendment was not properly ratified. However, the courts have upheld the Amendment in every case that challenged it.

State income taxes are determined within the jurisdiction of each state. There have been challenges to state income taxes, but in each case, state income taxes were also upheld. However, some states chose not to levy state income taxes and chose to levy taxes in other ways. In states that do not have state income taxes, taxes are levied in other manners, such as sales tax, higher property tax and many other circumstances.

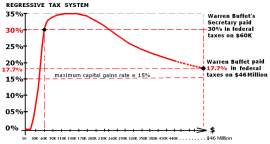

All forms of income taxes have been challenged because employers suggest that the taxes discourage employment in certain jurisdictions, personal savings and investments. Taxpayers may fear that certain income will push them into the next tax bracket, and therefore they may abstain from taking part in alternative forms of income. In addition, some corporations have challenged income taxes because the taxes can discourage business in certain jurisdictions based on tax rates.

Income taxes are consistently challenged as unconstitutional and bad practice. People that work harder, get an increase in salary, which also increases their tax burden. However, the Supreme court has ruled that income taxes are constitutional and necessary in order for citizens to contribute to the expenses associated with running the country. In fact, income taxes are simply considered a citizens contribution toward the costs associated with the benefits of being a citizen in the United States.

NEXT: Ratification of Sixteenth Amendment