Capital Gains Tax Rate On Real Estate

Capital Gain Property Tax.jpg

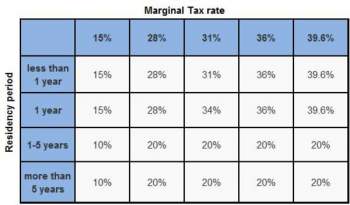

The capital gains tax rate on real estate varies according to several factors. The real estate tax will depend on whether the property sold was a primary or secondary residence, or simply a rental property. In order to reduce or eliminate the real estate tax, individuals should convert the property to a primary residence before selling it. The highest capital gains tax on real estate occurs when the property is used strictly as a rental property.

In most cases, individuals may sell their primary residence every two years and exclude various amounts from the real estate tax. In general, single individuals may deduct two hundred and fifty thousand dollars and married couples my deduct double that amount, before determining if there was a capital gain from the sale of the property.

In the past, these exclusions from the capital gains tax rate on real estate only applied in certain circumstances, such as for the elderly. There had also been a lifetime excision which allowed individuals to deduct a certain value from the real estate tax, over their entire lifetime.

However, in most cases, the rules have changed to allow most individuals to take advantage of more extensive exclusions and deductions. Individuals must simply live in the home as a primary residence for two years, before making the sale, in order to take advantage of exclusions and larger deductions.

United States Capital Gains Taxation (2008-2012)

Ordinary Income Short-term Capital Long-term Capital

Tax Rate Gains Tax Rate Gains Tax Rate

10% 10% 0%

15% 15% 0%

25% 25% 15%

28% 28% 15%

33% 33% 15%

35% 35% 15%

United States Capital Gains Taxation (2013+)

Ordinary Income Short-term Capital Long-term Capital

Tax Rate Gains Tax Rate Gains Tax Rate

15% 15% 10%

28% 28% 20%

31% 31% 20%

36% 36% 20%

39.6% 39.6% 20%

NEXT: Criticisms of Capital Gain Taxes