Knowing the Tax Income Brackets

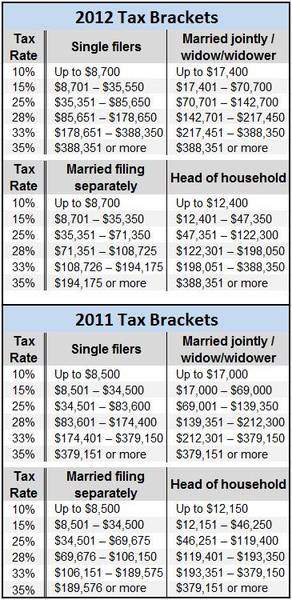

2011 FEDERAL TAX BRACKETS

SINGLE EARNERS

2011 FEDERAL TAX BRACKETS

• Taxable Income:

Income Tax:

• $0 - $8,500

10% of the amount over $0

• $8,501 - $34,500

$850 plus 15% of the amount over $8,500

• $34,001 - $83,600

$4,750 plus 25% of the amount over $34,000

• $82,601 - $174,400

$17,025 plus 28% of the amount over $83,600

• $174,401 - $379,150

$42,449 plus 33% of the amount over $174,400

• $379,151 +

$110,016.50 plus 35% of the amount over $379,150

MARRIED FILING JOINTLY

2011 FEDERAL TAX BRACKETS

• Taxable Income:

Income Tax:

• $0 - $17,000

10% of the amount over $0

• $17,001 - $69,000

$1,700 plus 15% of the amount over $17,000

• $69,001 - $139,350

$9,500 plus 25% of the amount over $69,000

• $139,351 - $212,300

$27,087.50 plus 28% of the amount over $139,350

• $212,301 - $379,150

$47,513.50 plus 33% of the amount over $212,300

• $379,150 +

$102,574 plus 35% of the amount over $379,150

MARRIED FILING SEPARATELY

2011 FEDERAL TAX BRACKETS

Federal Tax Brackets for those who are Married but File Separately:

• Taxable Income:

Income Tax:

• $0 - $8,500

10% of the amount over $0

• $8,501 - $34,500

$850 plus 15% of the amount over $8,500

• $34,501 - $69,675

$4,750 plus 25% of the amount over $34,500

• $69,676 - $106,150

$13,543.75 plus 28% of the amount over $69,675

• $106,151 - $189,575

$23,756.75 plus 33% of the amount over $106,150

• $189,575 +

$51,287 plus 35% of the amount over $189,575

HEAD OF HOUSEHOLD

2011 FEDERAL TAX BRACKETS

Federal Tax Brackets for those who file as Head of Household

• Taxable Income:

Income Tax:

• $0 - $12,150

10% of the amount over $0

• $12,151 - $46,250

$1,215 plus 15% of the amount over $12,150

• $46,251 - $119,400

$6,330 plus 25% of the amount over $46,250

• $119,401 - $193,350

$24,617.50 plus 28% of the amount over $119,400

• $193,351 - $379,150

$45,323.50 plus 33% of the amount over $193,350

• $379,151 +

$106,637.50 35% of the amount over $379,150

2012 FEDERAL TAX BRACKETS

SINGLE EARNERS

2012 FEDERAL TAX BRACKETS

• Taxable Income:

Income Tax:

• $0 - $8,700

10% of the amount over $0

• $8,701 - $35,350

$870 plus 15% of the amount over $8,700

• $35,351 - $85,650

$4,867.50 plus 25% of the amount over $35,350

• $85,651 - $178,650

$17,442.50 plus 28% of the amount over $85,650

• $ 178,651 - $388,350

$43,482.50 plus 33% of the amount over $178,650

• $ 388,350 +

$112,683.50 plus 35% of the amount over $388,350

MARRIED FILING JOINTLY

2012 FEDERAL TAX BRACKETS

• Taxable Income:

Income Tax:

• $0 - $17,040

10% of the amount over $0

• $17,041 - $70,700

$1,740 plus 15% of the amount over $17,040

• $70,701 - $142,700

$9,735 plus 25% of the amount over $70,700

• $ 142,701 - $217,450

$27,735 plus 28% of the amount over $142,700

• $ 217,451 - $388,350

$48,665 plus 33% of the amount over $388,350

• $388,350 +

$105,062 plus 35% of the amount over $388,350

MARRIED FILING SEPARATELY

2012 FEDERAL TAX BRACKETS

Federal Tax Brackets for those who are Married but File Separately

• Taxable Income:

Income Tax:

• $0 - $8,700

10% of the amount over $0

• $8,701 - $35,350

$850 plus 15% of the amount over $8,700

• $35,351 - $71,350

$4,750 plus 25% of the amount over $35,350

• $ 71,351 - $108,725

$13,543.75 plus 28% of the amount over $71,350

• $108,726 - $194,175

$23,756.75 plus 33% of the amount over $194,175

• $194,175 +

$51,287 plus 35% of the amount over $194,175

HEAD OF HOUSEHOLD

2012 FEDERAL TAX BRACKETS

Federal Tax Brackets for those who file as Head of Household

• Taxable Income:

Income Tax:

• $0 - $12,400

10% of the amount over $0

• $12,401 - $47,350

$1,400 plus 15% of the amount over $12,400

• $47,351 - $122,300

$6,642 plus 25% of the amount over $47,350

• $122,301 - $198,050

$25,380 plus 28% of the amount over $122,300

• $198,051 - $388,350

$46,590 plus 33% of the amount over $198,050

• $388,350 +

$109,389 plus 35% of the amount over $388,350

Income tax laws, which are established by the United States Federal Government through the administration efforts of the Internal Revenue Service do not vary based off of income brackets. That being said, the United States taxation system is a progressive model, which entails different tax rates based off the income tax brackets. The laws themselves are universal in regards to a mandatory payment of taxes for income earned, however, the rate at which individuals pay tax will fluctuate based on how income they obtain.

The progressive model of taxation in regards to the income tax places a greater responsibility on higher-income earners in the United States. Those individuals who make more money will be proportionately taxed at higher rates. As a result of this taxation method, the laws associated with income tax are universal; however, the percentages of the levy will vary in proportion to the individual's monthly salary.

NEXT: Find Your Tax Brackets For 2010