Death Tax at a Glance

The death tax is also known as the estate tax or inheritance tax, depending in the jurisdiction. Federally, the death tax is the estate tax, which is imposed on the value of the estate before it is distributed to beneficiaries.

There has been great controversy surrounding the death tax in the United States. Although the tax is not applied until after all expenses for the funeral have been paid, as well as monies due to creditors, the percentage of the death tax can include payment of over half the value of the estate to taxes.

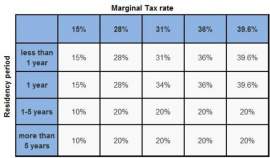

Critics of the estate tax or the death tax, argue that subtracting the expense of a funeral from the value of the estate, is not a substantial exemption. Instead, the death tax is imposed on the full value of the estate as a percentage that increases as the value of the estate increases, making those with more substantial estates being subjected to higher rate of taxation.

Critics argue that the death tax discourages savings and entrepreneurship. Those that save know that a majority if their savings will be taken for tax purposes, which discourages large savings accounts.

In addition, it discourages hard work, as those that have larger estates believe that the money made by their hard work, will go to taxes, rather than their family. Conversely, those that support the death tax state that no one is entitled to the money made form the hard work of one person, except for that person.

NEXT: Death Tax at a Glance