How the IRS Handles Charities

The Internal Revenue Service has awarded charitable donations as tax deductible expenses. "You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions." (IRS Publication 78.)

Donations made to charities will reduce an individual's taxable income which subsequently decreases the amount of tax owed. In order to claim such deductions an individual must itemize his/her donations made using the standard 1040 IRS tax form.

Under Schedule A of the 1040 IRS tax form, an individual will claim his/her tax deduction received from a charitable contribution. In order to be considered tax-deductible the gift of cash or property must meet certain criteria outlined by various IRS tax forms. Firstly, the tax-deduction is not eligible until the pledge is fulfilled and the gift is fully transferred to the charitable organization.

In order for the gift to be ruled deductible, it must be transferred to a charity, that under IRS rules, is designated as a qualified tax-exempt organization. Charities receive exemption through the completion of the IRS form 501-C, and will publicize their status as tax exempt to individuals interested in donation.

Some organizations such as churches or other religious organizations are not required to fill out IRS forms which designate tax-deductible statuses. If a donation was made to a tax-exempt organization the individual will not receive a deduction until his tax return is properly itemized in the 1040.

The Pension Protection Act requires all donations made to charitable organizations to be properly organized and filed. All donations made that do not exceed $250 will not be rendered as tax-deductible unless supporting documentation is obtained. Records must contain the amount of money donated, the name of the organization, and the date which the transfer occurred. Non-cash charitable donations must follow the strict rules outlined by the federal government to substantiate the fair market value of goods or property transferred to organizations.

If property is transferred it must contain the assessment value of the land in question and must coincide with the IRS form 8283 i the contribution exceeds $500. Non-cash contributions such as property, boats, cars, trucks, or airplanes must be attached with a market appraisal of the item and subsequently confirmed via a written document by the charity to solidify a tax deduction.

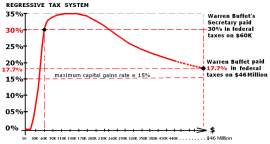

The Internal Revenue Service limits the amount of deduction awarded to individual donations. The IRS has instituted a 20%, 30%, and 50% rule for charitable donations-an individual can deduct cash contributions up to 50% of the adjusted gross income, 30% for property contributions, and 20% for appreciated capital gains contributions.

The following contributions are not made tax-deductible under IRS rules.

Donations made to political parties or campaigns

Contributions to individual people

Contributions to labor unions

Contributions to for-profit schools or hospitals

Contributions to foreign governments

Contributions made to professional organizations

Federal law has exempted charities from paying federal income tax. Under the IRS form 501(c)(3) the government has created two basic requirements that a charity must meet in order to be exempt from federal taxation-the organization in question must be created for a purpose that Congress recognizes as charitable and their ensuing actions must directly benefit others.

If successful in meeting these requirements; the only IRS forms that a charity must file are excise taxes in the form of telephone and gasoline levies. Charities also may be responsible for filing the IRS Form "UBIT"-Unrelated Business Income Tax-which taxes net earnings from activities that do not meet their charitable purposes.

All charities other than religious groups and small foundations (under $5,000 annually) are over sought by the Internal Revenue Service. Charities that receive over $25,000 a year in contributions must file an annual IRS tax form known as Form 990 or Form 990-PF.

These IRS forms are not for tax collection purposes, but instead, information documents that are made public to reveal the tax-deductible status of a charity and to report necessary financial numbers.

Under IRS form 501 (c)(3) the IRS separates charities into 2 broad groups:public charities and private foundations. Public charities commonly support universities or hospitals and are driven by public donations or funding.

Private foundations mostly receive funding from a limited group of individuals such as family members, or specific corporations. Private foundations are subject to harsher federal regulation and susceptible to more federal taxation methods.

NEXT: How Businesses Should Handle Their Taxes