Calculating Inheritance Tax

FORM 706 Estate Tax Return

FORM 706 Instructions

STATE INHERITANCE TAX RATE

Connecticut : (over $2mill:7.2~12.0%)(Gift Tax 12%)

Forms : S-1, S-2, Estate Gift Return, Non Taxable Return

Indiana : 20%

Forms : Tax Return

Iowa : 15%

Forms : Tax Return

Kentucky : 16%

Forms : Tax Return, Nontaxable Return

Maryland : 10%

Forms : Estate Tax Return

Nebraska : 18%

Forms : Estate Tax Return ('03~'07)

New Jersey : 16%

Forms : Tax Return Resident, Non-Resident

Pennsylvania : 15%

Forms : Application Tax Return Resident, Non-Resident

Tennessee : 9.5% (Gift Tax 16%)

Forms : Tax Return Long form, Short form

States with ESTATE TAX :

Connecticut, Delaware, D.C, Hawaii,

Illinois, Maine, Massachusetts,

Minnesota, New York, North Carolina,

Ohio, Oregon, Rhode Island, Vermont,

Washington.

States with INHERITANCE TAX :

Indiana, Iowa, Kentucky, Nebraska,

Pennsylvania, Tennessee.

States with GIFT TAX :

Connecticut, Tennessee

The inheritance tax, also referred to as the estate tax, is the taxation on assets received passed from a person who has died. An inheritance tax is instituted in nations throughout the world, with both the United Kingdom and the United States requiring they be paid upon passage of property. Different states in the United States even have their own inheritance taxes on top of Federal taxes. These states include Indiana, Iowa, Kentucky, Maryland, Nebraska, New Jersey, Oklahoma, Pennsylvania, and Tennessee.

How Inheritance Taxes are calculated

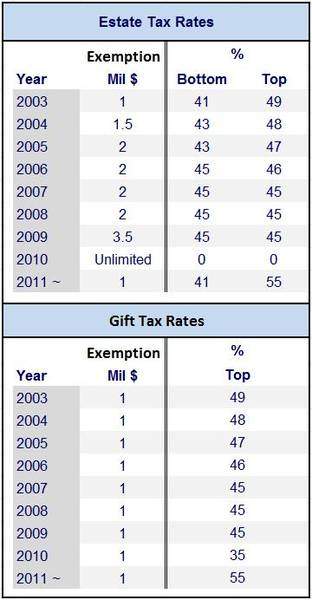

In the United States, the estate tax is determined by looking at the “entire estate” that is left after a person's death. This inheritance tax is also a part of the overall gift tax regulations, which means that the inheritance tax cannot be avoided by gifting properly before death, as similar tax consequences will be required.

1. The Gross Estate

The gross estate, which determines how much property and assets will be subject to tax, will often include much more than is devised through a will or probate. In its simplest form, the gross estate consists of all property owned by the decedent at the time of his or her death. The gross estate includes:

- Property or assets the decedent transferred up to 3 years prior to their death.

- Annuities in the descendant's name.

- The value of jointly owned property, with special rules for property co-owned by a spouse.

2. Deductions Allowed from the Estate Tax

Once the value of the gross estate is determined, numerous deductions can be made before the tax rate is applied. The following are some deductions that will be made:

- Estate administration expenses and funeral expenses.

- Qualifying charitable donations.

- Property left to a surviving spouse.

- Property left in a qualified domestic trust.

3. Exemption from Federal Inheritance Tax

Recently, the inheritance tax in the United States has gone through many changes. In 2010, the Federal Estate Tax was not renewed, therefore no estates were taxed if the decedents died during the 210 tax year. For 2011, Congress re-enacted the tax, however all estates will gross estate values of less than $5 Million are exempt from the estate tax. Estates that are over the $5 Million mark are taxed at 35%, but only for the amount over $5 Million.

4. State Specific Inheritance Taxes

While the federal inheritance tax does not affect most estates, as most estates will fall under the $5 Million exemption, some states do impose their own estate tax. State estate taxes vary greatly, so it is important that you look into your specific state's laws before making estate planning decisions. Some states mirror the federal exemption, however many states with their own inheritance taxes will impose taxes even if no federal taxes will be imposed.

Legal Issues of the Inheritance Tax

While the inheritance tax is set for the 2011 and 2012 years, it is uncertain how they will be dealt with after the law expires. The estate tax laws have been change 19 times in 35 years, requiring estate planning professionals to change the estate planning of their clients very often.

NEXT: What to Know About International Taxation