A Quick Explanation of Duties

INDIVIDUAL DUTY RATES

A duty is a charge that can be implemented on certain items that are being brought into a nation. Often this is called a customs duty; a customs duty can be put on items like tobacco, alcohol, gifts, and various other items.

Duties are subject to change under the government in which the items are being brought into. This is because certain items are considered to be more exotic or are a riskier product grouping to bring into the nation. Often the duties that are incurred on these items are considerably more money. This is to help discourage a significant movement of these items into a nation.

There is also a term called duty free; these are items that are allowed into nations without the implementation of a duty. Often this is where individuals attempt to bring in as much as possible. Because of the overuse of this privilege, serious restrictions have been implemented in various nations regarding the ability to bring duty free items in. These restrictions were put on the number of items and the kinds of items.

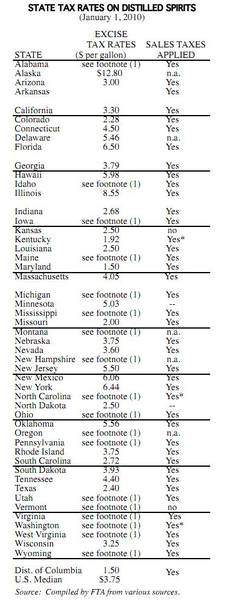

There are also duties that are paid by those who sell items in countries; these are often referred to as excise duties. An excise duty is a charge that is paid by the supplier or seller of products to the nation; the theory behind this is that the money for the fee will be made up when the seller increases the pricing of the products. Once these products are purchased and taken out of the nation, the buyer is subject to paying a duty for them, regarding customs.