Federal Car and Hybrid Car Tax Credit Details

Hybrid Car Tax Credit.jpg

What is the Federal Car Tax Credit?

The Federal Car Tax Credit is a program implemented by the Federal Government of the United States to provide a benefit to those consumers who purchase fuel-efficient or hybrid vehicles. The program is implemented by the United States Department of Energy to ultimately decrease our reliance on foreign oil and to mitigate the negative externalities imposed by the widespread use of oil.

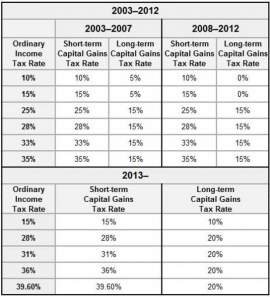

The Federal Car and Hybrid Tax Credit will reduce the total amount of income tax are required to pay. So, for example, if you owed $8,000 in federal income tax, a $1,500 tax credit would reduce your total amount owed to $6,500. The Federal car Tax Credit differs from a standard tax deduction, which reduces the amount of income for which you are formally taxed. So, for example, if your taxable income is $35,000, a $3,000 tax deduction would reduce your income to $32,000. Below you will find all information concerning the federal car and hybrid tax credit for vehicles purchased prior to December 31st of 2010:

Federal Car and Hybrid Tax Credit for Electric Vehicles:

Requirements for Electric Cars:

To be eligible for the Federal Car and Hybrid Tax Credit by your vehicle’s manufacturer, your vehicle must adhere to the following provisions:

• The vehicle must be made by a manufacturer

• The vehicle must be treated as a motor vehicle and must adhere to all the provisions outlined in title II of the Clean Air Act.

• The vehicle must have a gross vehicle rating of no more than 14,000 lbs.

• The vehicle must be propelled to a significant extent by an electronic motor; this motor must draw its electricity from a battery that has a capacity of no less than 4 kilowatt hours. The battery must also be capable of being recharged from external sources of electricity.

• The vehicle must be new.

• The vehicle must be purchased by the taxpayer applying for the Federal Car and Hybrid Tax Credit for Electric Vehicles.

• The vehicle must be used predominantly in the United States

• The vehicle must be placed in service by you, the taxpayer, during or subsequent to the 2010 calendar year.

If your vehicle meets these provisions, you must fill out Form 8936 (The Qualified Plug-in Electric Drive Motor Vehicle Credit Form) to claim your tax credit. This form may be filed with your Form 1040.

Federal Car and Hybrid Tax Credit for Alternative Fuel Vehicles:

To be eligible for the Federal Car and Hybrid Tax Credit for your newly-purchased Alternative Fuel Vehicle, the car must meet the following requirements:

• The Alternative fuel vehicle must utilize the following fuels to propel itself: compressed natural gas, liquefied petroleum gas, hydrogen, liquefied natural gas or any other liquid comprised of at least 85% methanol by volume.

• Your vehicle also must commence with you, the taxpayer.

• The vehicle must be acquired for use or lease by you, the taxpayer. The Federal Car and Hybrid Tax Credit is only available to the original purchase of an alternative fuel vehicle.

• The vehicle must be driven predominantly in the United States

If your vehicle meets these provisions, you must fill out Form 8910 (The Alternative Motor Vehicle Credit Form) to claim your tax credit. This form may be filed with your Form 1030. Additionally, some local or state governments may provide additional incentives for newly-purchased alternative fuel vehicles.

Federal Car and Hybrid Tax Credit for Diesel Fuel Vehicles:

To be eligible for the Federal Car and Hybrid Tax Credit for your newly-purchased Diesel Fuel Vehicle, the car must meet the following requirements:

• The original use of the car must commence with the taxpayer

• The car must be acquired for use or lease by you, the taxpayer, and not for resale. The Federal Car and hybrid Tax Credit for Diesel fuel vehicles is only offered to the original purchaser of a new qualifying diesel vehicle. If the vehicle is leased to a consumer, the leasing company may claim the tax credit.

• The diesel-fueled vehicle must be used primarily in the United States.

• The vehicle must be placed in service after December 31st of 2005 and must be purchased before December 31st, 2010.

If your vehicle qualifies, you must fill out Form 8910 (The Alternative Motor Vehicle Credit Form) to claim your tax credit. This form may be filed with your Form 1030. Additionally, some local or state governments may provide additional incentives for newly-purchased alternative fuel vehicles.

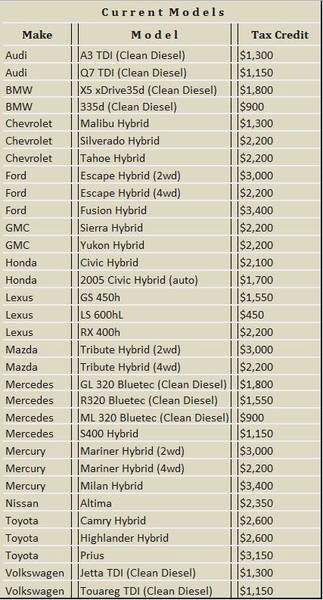

Federal Car and Hybrid Tax Credit for Hybrid Vehicles:

Hybrid vehicles placed into service or purchased before December 31st of 2005 may be eligible for the Federal Car and Hybrid Tax Credit for an income tax credit of up to $3,500. To secure this tax credit your newly-purchased Hybrid must meet the following requirements:

• The original use of the Hybrid must commence with you, the taxpayer.

• The hybrid must be acquired for use or lease by you, and not for resale. The Federal Car and Hybrid Tax Credit is only offered to original purchasers of new qualifying Hybrid vehicles. If the Hybrid is leased, the leasing company is free to claim the Federal Car and Hybrid Tax Credit.

• The Hybrid vehicle must be used primarily in the United States.

• The Hybrid vehicle must be placed in service by you following the 31st of December 2005 and must be purchased on or before the 31st of December 2010.

If your vehicle qualifies, you must fill out Form 8910 (The Alternative Motor Vehicle Credit Form) to claim your tax credit. This form may be filed with your Form 1030. Additionally, some local or state governments may provide additional incentives for newly-purchased alternative fuel vehicles.