A Complete Guide on Inheritance Taxes

Inheritances taxes are either collected from an estate of from the individual that inherits from the estate. Like other taxes, inheritance taxes are determined as a percentage of the total value of an estate, on the day that an individuals inherits from the estate. In some cases, an inheritance tax is also known as an estate tax. In the United States, there is a distinction between an inheritance tax and an estate tax. An estate tax is generally the tax imposed on the actual estate, before anyone inherits from the estate. Whereas, an inheritance tax is imposed on the individuals that inherit from an estate. The inheritance tax would generally be calculated on the vale of inherited property, on the day that an individual inherits said property, or the day that the benefactor passes away.

Some states impose an inheritance tax on the beneficiaries of an estate, while

others do not. There are also jurisdictions that impose both an

inheritance and an estate tax. While some states impose an inheritance tax, the

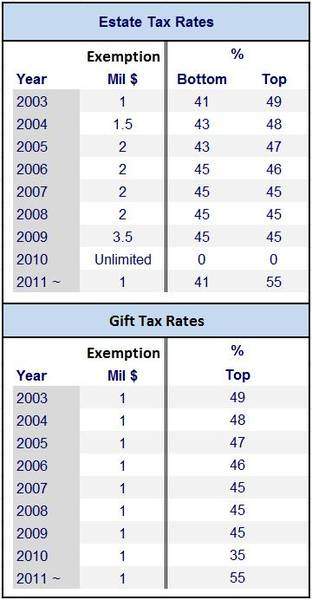

federal government imposes an estate tax. The estate tax is set to expire in

2010 and it is difficult to ascertain what may result from the expiration of

the estate tax. Many States have begun to allow their inheritance tax statutes

to lapse or expire. However, the federal government is not likely to allow the

estate tax to expire. The expiration could result in Congress passing an estate

tax that could be levied against a larger percentage of assets. In fact, many

members of the tax reform movement believe that is likely to happen. However,

the lapse could also result in a lowered percentage of estate taxes, or a

complete lack of an estate tax. Although the tax may expire, that does not mean

that the government cannot in fact, tax an estate afterwards.

Beneficiaries are likely to be in tax limbo until the issue is resolved by

Congress. Yet, beneficiaries are likely to be aware of what their inheritance

tax burden will be in their state.

In most jurisdictions, an inheritance tax is dependent on the type of assets

and property that an individual inherits. Another factor in inheritance taxes

is the beneficiaries relationship with the deceased. Generally, the closest

relatives, children and parents, are taxed at a lower rate than other

beneficiaries. In most cases, beneficiaries will be responsible for an

inheritance tax burden based on the total value of inheritance. Inheritances

tax burdens can end up being a large percentage of inherited property. Often,

those percentages are determined based on the size of an estate. Like many tax

brackets, inheritances tax percentages tend to increase with the size, or value,

of an estate.